Perhaps the ultimate in “risk takers” in the insurance profession are space underwriters. As they try to match premium income against the risk of losses, their annual results and even their job prospects can sometimes hinge on a single spacecraft or on a single rocket launch. Following the recent trend, 2012 was again a profitable year with a net underwriting result (i.e. before costs and expenses are deducted) of circa $400 million. But practitioners in this most glamorous and devil-may-care class are worried that the good times may not continue for long.

For most space risks several underwriters provide the cover

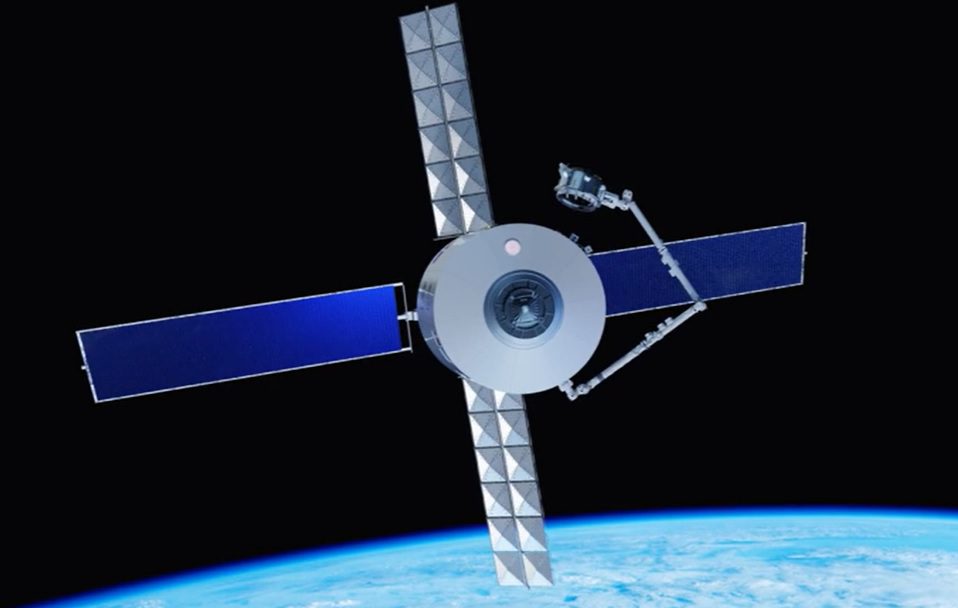

Space Insurance is involved in covering space risks from before launch to several years into the lifespan of a satellite depending on the economics of doing so. Usually, the most important in terms of financial value are launch insurance policies. These usually cover a space risk from the intentional ignition of a launch vehicle right up to the end of the first year in space. Subsequent to this, the in-orbit life of a satellite is usually covered, like automobile insurance, on an annual renewal basis. Some underwriters also cover third party liability risks involved with launching and operating satellites and also the related pre-launch “cargo” insurance involving transport of satellites to the launch site.

There are about thirty underwriting companies and consortia around the world each vying for a share of individual space risks. Each will have a maximum “capacity” with which to underwrite with. For example, a typical underwriting firm may have a capacity of $20 million, and thus may theoretically have the ability to cover a one twentieth share of $400 million policy. A typical premium rate for a launch plus one year risk might range from 7% to 15% according to how reliable the launch vehicle and satellite design is. The annual premium rate for in-orbit cover after the first year in orbit is typically 0.6-1% per annum. Space insurance policy wordings will also have clauses noting exclusions, depreciation rates, redundancy, margins, constructive total loss trigger point, etc,

Underwriters compete with each other

Those that wish to have their space risks insured are usually satellite operators, but they can also involve manufacturers, space and defence agencies, and even launch providers themselves especially if they offer a “free reflight” in case of failure. Such an organisation will approach an insurance broker to arrange this insurance with a number of underwriters. Under the current “vertical marketing” the underwriters compete with each other on the premium rate and terms they are prepared to accept.

Three main space insurance brokers, AON-ISB, Marsh and Willis dominate the business with some smaller broking firms also active in the market. The insurance underwriters take a share of the risk. For financial reasons they may decide to offload part of their risk to other underwriters using the reinsurance market; in essence becoming the “insured” themselves. This can be done on an individual risk basis under facultative reinsurance for individual risks, or covering the insurer’s entire book of risks via a treaty or quota share arrangement.

Space insurance is a volatile class

Unlike some other classes which have a large population of insured risks, for space insurance the number of risks is small. As such, with such a small spread, sometimes the difference between a profitable and loss making year, can often be only a single loss event. While the term volatility has often been misused in the financial press, space insurance can suffer from it in its correct sense: very large ups and very large downs.

While the space insurance market has been profitable for several years, major net losses occurred in the late 1990s and early 2000s in which underwriters lost billions of dollars. The losses resulted from insurers cavalier attitude to policy wordings coupled with a rise in the number of loss events.

The key factors were:

– Multiple years of post-launch coverage not accounting for faults that worsen

– Spacecraft insured values not being depreciated properly with respect to time

– Generic faults resulting in many satellites being launched with the same fault

– Underwriters being pressurised into accepting rates too low for the risks concerned

– Increasing losses mainly relating to new rockets or satellite technology

While many of the mistakes have been rectified resulting in the insurance market returning to profitability, satellite operators were disdainful over some of the changes and noted that some space insurance policies had become no longer good value for money. For example, with the ending of multi-year post launch in-orbit insurance at each annual renewal insurers were able to impose exclusions every year according to what faults showed themselves to the insured and related satellites. Brokers note that while insurers initially sought to exclude everything that was problematic, since then there are signs that they have taken a more balanced view to the application of “equipment based” exclusions

Some losses but overall 2012 was a very profitable year

On a calendar accounting basis, in 2012 the space insurance market as a whole returned a very healthy profit continuing the profitable trend of recent years. Nevertheless, insurers are concerned that with incoming capacity attracted to this profitable class, premium rates will fall further, making it more likely that unprofitable years will be ahead.

“Insurance rates are largely driven by supply and demand. The over-supply of capacity currently available has increased competition and driven rates to some of the lowest levels ever seen” said David Wade, Space Underwriter at the London-based Atrium Space Insurance Consortium (ASIC).

Underwriters are even more concerned about the lack of differentiation between reliable launch vehicles and spacecraft and their less reliable brethren.

“Despite losses, rates have continued to be put under pressure and, significantly, the differentiation between different risks has been eroded to a point where it is minimal,” warns Wade.

With respect to the actual losses, while the late 1990s and early 2000s were dominated by in orbit failures, the losses incurred in 2012 were more dominated by launch vehicle and upper stage launch vehicle failures rather than in-orbit spacecraft unreliability.

SPACE INSURANCE CLAIMS AND EXPECTED CLAIMS FOR 2012

|

Spacecraft |

Date of Occurrence |

Expected Loss/Claim |

Cause |

|

INTELSAT 19 |

01/06/2012 |

84 |

Due to design/manufacturing issue, South solar array had trouble being deployed after launch and a power shortfall of circa 50% (25% for the whole spacecraft) still exists. Also incurred fuel loss during recovery. |

|

EXPRESS-MD 2 |

06/08/2012 |

38.4 |

Proton M Breeze M Upper stage premature shutdown caused satellite to be stranded in useless orbit. |

|

TELKOM 3 |

06/08/2012 |

185 |

Proton M Breeze M Upper stage premature shutdown caused satellite to be stranded in useless orbit. |

|

ORBCOMM OG2-01 |

08/10/2012 |

10 |

Falcon 9 launch vehicle first stage engine failure and restrictions on fuel use in favour of main Dragon CRS payload resulted in stranding and re-entry. |

|

YAMAL 402 |

08/12/2012 |

108 |

Proton M launch undershoot following Breeze M upper stage fault. Recovered but 4 years of 15 year lifespan lost. |

|

|

EXPECED TOTAL |

425.4 |

|

Source: Flightglobal SpaceTrak online database

Set against these losses which total $425.4 million (preliminary estimate) are gross launch and in orbit premium revenues of circa $859 million. This premium total increased compared to the previous year despite lower premium rates and was due to an increase in the number of high value satellites as part of fleet replenishment programmes. However, now that fleet replenishment launches are passed their peak, the number of insured launches is likely to fall and underwriters are fearful that premium income will also fall in coming years, to the point where the premium cannot cover losses.

David Wade of the underwriting consortium, ASIC warns of “a withdrawal of capacity; less competition and a substantial increase in insurance rates across the board when the inevitable losses occur.”

Some insurers note that compared to some related insurance classes such as aviation analysis of market stability is difficult due to the time lag between setting rates and the policies actually starting.

“We don’t know at the end of an underwriting year if our business is still sustainable or not because we have a lag factor. Meaning that satellites we insure today, will only be launched in maybe two or more years from now.” Said Jan Schmidt, Space Underwriter at Swiss Re.

Fears over multiple launches and over new launch vehicles and new technology

As already mentioned, underwriters do attempt to differentiate their rates between the lesser and high risk placements. For example, a satellite flying on an Ariane 5 with its continuous run of 53 successful flights will usually get a lower insurance premium than the equivalent satellite flying on a less reliable rocket.

But the Ariane 5 also causes fear. For while the Ariane 5 rocket’s reliability is admired, the flying of two high value insured spacecraft on the same launch concerns many in the market.

“As sums insured continue to increase and due to the accumulation of exposure on dual launches in particular, the insurance market will probably find itself with insufficient premium to pay a single large loss.” Said David Wade of ASIC.

While the Ariane, Proton and Soyuz launch vehicles have been the mainstay of commercial flights and are a known quantity, they are now being joined by a new and diverse range of launch vehicles. The low cost SpaceX Falcon 9 launch vehicle has become the main challenger to Arianespace’s Ariane 5 for commercial satellite flights especially now that lightweight “all electric” communications satellites are coming on stream. However, such has been the Falcon 9’s marketing success that its schedule is now becoming clogged.

Meantime, China’s CGWIC (China Great Wall Industry Corp) and Japan’s Mitsibushi are now offering “turnkey” contracts that offer a full service to both construct a communications or Earth observation satellite and launch it on one of one of their Long March 3B or H2A launch vehicles respectively. They are beginning to win orders in this way.

Sea Launch is fully back in business and is now becoming the ‘reserve launcher’ of choice for operators as they book with Arianespace or SpaceX.

While different (and cheaper) launch options are attractive to operators, satellite operators also want to use new communications payload, electric thruster and power generation technologies to help their operations and market competitiveness. They accuse insurers of not letting them get cutting edge technology.

From their experience with “new technology” losses in the late 1990s and early 2000s, underwriters remain resistant to insuring new untried technology.

Will “underwriting by e-Bay” destabilise market?

While underwriters, satellite manufacturers and launch providers have all learned lessons from the past, there are fears that the insurance cycle may undo some of this good work. For as insurance firms and capacity becomes attracted into this “profitable” class, rates will be forced downwards and sometimes to a level which will not cover the losses. The same effect can be seen on policy conditions as well, with launch plus multiple years back on the scene.

While whereas previously lead underwriters agreed the premium rate and terms of the policy, criticised as effectively being “price fixing”, under vertical marketing now each underwriter has to bid his own premium rate to the broker. The broking firm acts on the insured’s behalf in assembling the necessary insurance capacity. Detractors of this new method note it is like a blind auction describing it derisively as “underwriting by e-Bay” rather than a true expert negotiation.

They further point out that while these lower rates may be good for the insured in the short term, in the longer run such methods can actually accelerate destabilisation of the market – especially if inexpert space underwriting capacity is taking part. The end result will be that rates may have to rise again which may not be in the longer term interest of satellite operators.

As a broker, Yamin Mustafa, Managing Director of Marsh gives his own advice to insurers at a time of overcapacity warning that going back to the high rates and restrictions of the recent past would be a mistake:

“We believe that the Insurers who will be most successful in the long term are those that offer a high quality service to customers.” Mustafa said.

“By this we mean giving fair consideration to all of a customer’s risks, providing financially secure underwriting capacity, providing competitive pricing, not placing onerous technical demands on customers and being responsive in loss scenarios” he added.

Some underwriters are confident enough not to follow the herd as they try to give clients what they want, even if this means taking an apparently riskier approach. About five years ago, Swiss Re, a major Switzerland-based underwriting firm which has a space insurance capacity of $75 million, broke ranks and began offering launch plus three and launch plus five year policies again; the theory being that the highest risk of failure lies in the launch and first year rather than the “safer” later years. Since then other underwriters have followed the Swiss Re lead in again offering longer post launch cover.

“Some clients love it.” said Jan Schmidt, Space Underwriter at Swiss Re, noting that so far the strategy had paid off.

“We’ve had a few losses under these multi-year policies already, but overall it seems that satellite reliability has got better as there have been hardly any in-orbit losses post IOT (In-Orbit Testing)” said Schmidt, before adding that “mature technology should probably take the credit”.

Nevertheless, Schmidt knows his multi-year policies do have a “Sword of Damocles” hanging over them: they can be caught out by unexpected generic faults with new technology. In-orbit insurance policies with annual renewals do not have the same exposure to major losses as they can exclude known faults that could worsen. Jan Schmidt notes the bad past experience the market had twelve years ago with such multi-year policies but added: “If you are charging an adequate risk premium (for the extra years) then you can do it.”

There are good underwriters…and those that think they are good

It is not just rates that shape the market, personalities can have an effect as well. Mustafa noted the egos and pride involved in space insurance and warns that this can add complication and cost to the placement of space insurance risks.

“Space Insurance is unusual in that a very high proportion of Insurers regard themselves as “leading underwriters.”” notes Marsh’s Yamin Mustafa.

However, Mustafa does agree that there is a difference in the quality of space underwriters which became especially apparent after the introduction of vertical marketing.

“Insurance losses do not fall equally across all Insurers.” noted Mustafa. “Whilst Individual Insurers do not disclose their results, our studies indicate a noticeable variation in profitability from insurer to insurer.” Mustafa added.

The operator’s view: Experienced spacecraft designs are reliable but new technology is wanted as well

While underwriters and brokers have their own thoughts about the space insurance market, probably the one that counts most is their clients’ view. Major satellite operators have, as the insured, benefited recently from falling premium rates.

Ruy Pinto, Chief Technology Officer of the mobile satellite services firm Inmarsat which insures its fleet of satellites on the international market, concurred with the view that this trend has been partly due to improvements in in-orbit reliability which was, in turn, probably the result of a more evolutionary approach to satellite technology. Pinto however warned that operators also wanted new spacecraft technologies as they stretch for ever more capability but said that this risk could be managed. “Inmarsat ensures that thorough and extensive development, qualification and flight acceptance test programs are in place to ensure the flight worthiness of new technologies.” Said Pinto.

With respect to what insurers can do, Ruy Pinto also noted his approval for the re-emergence of launch plus multi-year insurance policies. “More creative deals work well for operators,” he said.

While Inmarsat has never made an insurance claim for loss on its satellites, Pinto did express concern that improvements in satellite reliability had not been matched recently by certain launch vehicles. For Pinto knows that however good his firm’s past record, Inmarsat might yet one day be caught out by an unexpected launch failure.

Pinto declined to confirm that Inmarsat’s exemplary insurance claims record had resulted in lower insurance premium rates when compared to other operators. Instead he suggested that Inmarsat had been treated well by the insurance market due to its policy of disclosing its technology and in its dealings with its manufacturers and their quality control processes. Inmarsat famously locates its own overseeing engineering teams inside the manufacturers it uses

“We are very transparent with them (the insurers) and we think this pays off” said Pinto before adding: “Seasoned operators like us are viewed (by the market) as being lower risk and, therefore, that allows better value for money agreements for both sides.”

Debris and solar risks are still there but it depends on the orbit

It is not just falling rates and fears over space systems’ unreliability that cause underwriters to lose sleep, some “natural threats” such as space debris and solar and meteor storms also threaten to produce insurance losses.

The subject of space debris had mixed messages for space insurers. For those commercial satellites likely to be insured from Low Earth orbit (LEO) operations it is noted that the risk of a debris strike is increasing – mainly because of the increasing use of polar and sun-synchronous orbits. Analysis of the risk of a debris strike is that it is currently circa 3% over the lifetime of a spacecraft. Efforts to reduce this by debris mitigating efforts such as re-entering old spacecraft and rocket stage unused propellant evacuation will have a long term effect, as will the natural self-cleansing nature of these orbits given the atmospheric drag present.

Nevertheless, while the lack of atmospheric drag there means that Geosynchronous Earth Orbit (GEO) cannot “clean themselves” of debris, most insured spacecraft which reside in this orbit are actually much “safer” from space debris. This is because there is a much lower density of space debris along with much lower relative velocities between such debris and any GEO spacecraft resulting in a much lower chance of a loss or failure due to a debris strike. Analysis has shown that the risk of such an occurrence is 1000 times less than for those satellites in LEO.

GEO spacecraft are not out of the woods however. Apart from possible strikes by meteor showers, Cosmic rays and high energy charged particles from the sun remain a risk to GEO spacecraft. And their brethren in lower orbits are at risk too, despite mostly flying beneath the protection of the Van Allen belts. For they still face hazards of higher concentrations of charged particles at the “South Atlantic anomaly” and cosmic rays leaking through at the poles (for those flying over them). However, the risk of spacecraft electrostatic discharges and logic “bit flips” has been somewhat mitigated by special electromagnetic hardening and the use of Faraday cages in spacecraft design. Thus while a very rare “Carrington class” solar event (the intense solar/geogmagnetic storm of 1859) could cause damage to a significant number of satellites, in fact space weather events present relatively much more risk to the Earth’s ground based power lines and oil pipe lines than they do to space hardware.

Of course, it is not just radiation and debris hazards that might affect spacecraft. The risk of military attack is increasing, especially now that commercial satellites often carry military hosted payloads or themselves provide communications services and imagery for military use. While hostile anti-satellite strikes by ground launched missiles and lasers or even hi-jacking attacks by computer hackers remain dangers, war/terrorism risks are usually excluded in most space insurance policies.

Then again, given that space insurers already have launch vehicle upper stage failures, potentially unreliable new satellite and launch vehicle designs, and falling premium rates to contend with, perhaps space insurance remains risky enough, even without military hazards to fret about.

That said, even when things are going well for space insurers, like the members of those other naturally pessimistic professions, farmers and shop keepers, they will always find something to moan about.

Post script: Since the posting of this article, the first space insurance loss event for 2013 has occured. In a Zenit 3-SL sea launch rocket failure, Intelsat 27 was lost on 1 February. The satellite’s insured value including the main policy and top-up polices totalled $406 million.