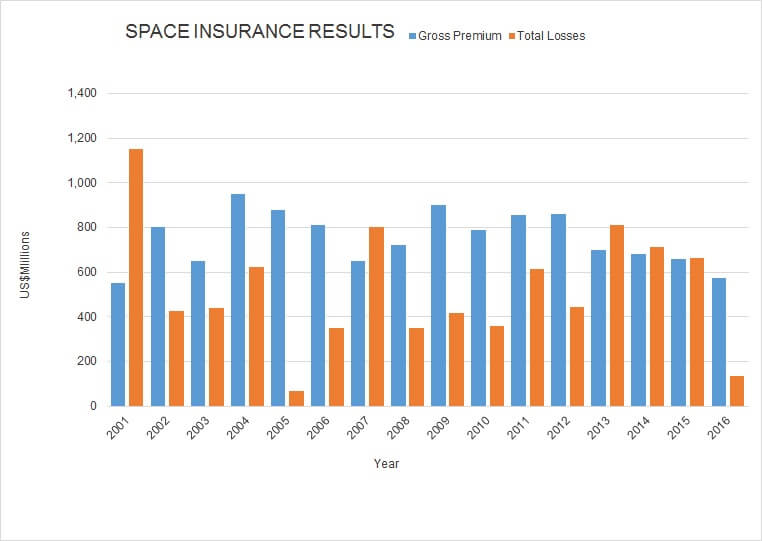

The first official space insurance loss of 2017 occurred when CAN$3.5 million (US$2.6 million) was paid to ExactEarth for the total loss of one of its exactView satellites (believed to be EV-5R) on 3 February 2017. Insurers will be hoping that losses remain low, especially as space insurance premiums remain depressed due to a soft market.

This factor, combined with launch delays due to technical failure, resulted in the lowest premium level for 15 years at US$575 million gross for 2016. Luckily for underwriters, overall losses and expected losses from pending claims during the year remained considerably lower at circa US$125 million. So, on a calendar basis, 2016 was a very profitable year for most space underwriters.

The pre-launch Falcon 9 explosion loss of AMOS-6 is not counted under space insurance but rather as part of the “cargo class”.

The result was unexpected and against the trend, given that during the three previous years the market registered overall small losses, according to Seradata figures. The expectation for the next few years is that, while reliability has improved overall, new inexperienced launch vehicles coming onto the market will cause more failures, and thus claims to rise.

Space Insurance Premiums were at a 15-year-low in 2016, but losses were low as well. Source: Seradata SpaceTrak database/Survey of insurers

A full round up of the space insurance year including a survey of launch premium rates is available to Seradata SpaceTrak subscribers in the Documents section here.