The Lloyds of London insurance market has introduced a ban on its workers from drinking during the standard office hours of 9 to 5, effectively ending lunchtime visits to the pub.

Working time alcohol bans originally started with local councils in Britain trying to correct the unfairness of its drivers and heavy machinery operators being banned from drinking alcohol during the day, while their fellow “white collar” council office workers were not similarly affected. Likewise, the pro-multicultural move also prevented some minorities being offended by the consumption of alcohol.

Following these councils were companies who realised that both discipline and performance sometimes suffered when employees came back to work after a drink at lunch at the pub. Now where they have led, so the 329 year-old Lloyds of London insurance market has followed with its own alcohol ban. However, in what amounts to a “classist” element, the ban does not affect underwriters. That is, the lowly paid cleaner at Lloyds cannot have a drink at lunch but the notionally richer underwriter can.

Critics note that such alcohol bans are symptomatic of the increasing controlling interference and authoritarianism of employers. They state that such bans are often hypocritical given that these same firms often lay on booze-laden Christmas celebrations for staff, but for cost reasons provide little food to soak it up.

As it is, the Lloyds of London Corporation itself is under especial criticism as it runs an “All Bar One” food and drink establishment located in part of its building structure which specifically encourages lunchtime drinking.

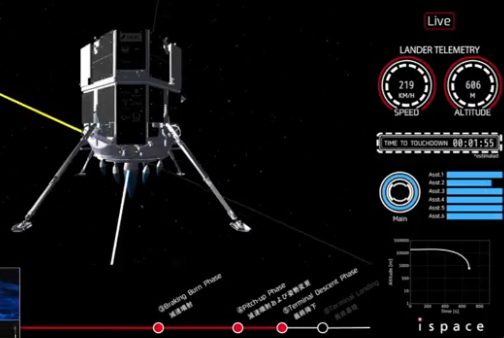

While Lloyds of London is not the power it was, its still a place of specialist underwriting including space underwriting. Courtesy: walklondon.com

Within the insurance market itself, there is relief that the ban does not directly affect them (class arguments aside). Actually, while most of the boozy business lunch culture had just about died out by the 2000s, a lot of business is still done at lunchtime. This is despite the hard drinking “boozy barrow boys” and “plastered posh public school types” having how made way for soberer (and possibly more boring) technocrat types such as actuaries, mathematical modellers, scientists and former engineers (especially in the space insurance class).

For while etiquette dictates that detailed business discussions should be left behind at socialising lunches (with alcohol involved to help proceedings), in truth many deals are often started there.

Meanwhile, the insurance brokers operating on behalf of their clients (the insured) are also relieved. For the wilier ones often wait for drunk and dozy underwriters to come back in the afternoon from their alcohol-laden lunches before they tried to pull a stroke against them with their low premium rates and dodgy policy conditions.

There have, of course, been some notably poor space risks passed onto other classes in some clever sleights of hand. Famously, it must have been on one of these afternoons when a broker managed to pass off a Spacehab module carried on the Space Shuttle as a cheap-to-insure aircraft cargo risk. It was subsequently lost with the sadly fatal re-entry destruction of STS-107 Columbia space shuttle mission in 2003.

More recently, last year cargo underwriters were stung by the prelaunch explosive loss of Amos-6. They apparently had no idea that their payload was allowed to be atop a SpaceX Falcon 9 rocket during a fully fuelled live firing test. As such, perhaps underwriters (at least the cargo ones) might be wise to be more sober in future.

Of course, even a partial lunchtime alcohol ban might at least help Lloyds with its reputation after tales of raucously louche behaviour. These include press reports about amorous insurance couples “going for it” in the transparent glass outside lifts/elevators of the famous Richard Rodgers designed Lloyds building.

Those engaged in such activities apparently had to work fast at their attempts at “lift love” as the ride only takes about 10 seconds, and stopping the lift between floors tends to cause security personnel to get involved.

No altimeter is needed to tell you have reached “cloud nine” but some lightning fighter jet controls might be required (see below).

This panel from the cockpit of Lightning T5 supersonic aircraft (aptly located between pilot’s legs) has the button you need in a Lloyds of London lift/elevator. Well, just so long as the flaps are in the right position. Courtesy: Crown Copyright via ScottBouch.com